SOURCE: AFI

The Indian Air Force (IAF) is grappling with a critical shortfall of nearly 200 fighter jets as of March 06, 2025, a gap that threatens its operational edge in an increasingly volatile region. With an additional 250 aircraft slated for retirement by 2040—including aging MiG-21s, MiG-27s, Jaguars, and early Mirage 2000s—the IAF faces the daunting task of acquiring approximately 450 new jets over the next 15 years. This figure, equivalent to the entire current fighter fleet of the Pakistan Air Force (PAF), underscores the scale of India’s modernization challenge. To bridge this gap, the IAF is banking on a multi-pronged strategy involving the Tejas Mk1A, Tejas MkII, Advanced Medium Combat Aircraft (AMCA), and the Multi-Role Fighter Aircraft (MRFA) program, though significant hurdles remain.

Currently, the IAF operates around 31 squadrons (each with 18-20 aircraft), well below its sanctioned strength of 42 squadrons needed to counter dual threats from China and Pakistan. The shortfall of 200 jets reflects delays in procurement, production bottlenecks, and the phased retirement of legacy platforms. Over the next 15 years, as 250 more aircraft retire, the IAF’s requirement balloons to 450 jets by 2040—a timeline critical to maintaining air superiority in the Indo-Pacific region.

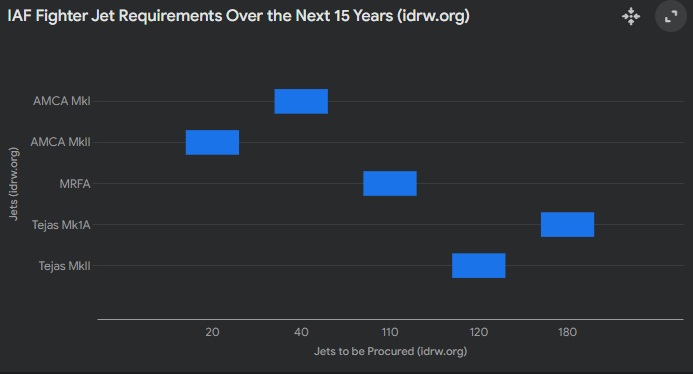

The backbone of the IAF’s near-term plan is the indigenous Tejas program, led by Hindustan Aeronautics Limited (HAL). The IAF has committed to procuring 83 Tejas Mk1A jets, with an additional 97 ordered in February 2024, totaling 180 aircraft. Priced at approximately ?45,000 crore (around $5.4 billion), the Mk1A—a 4.5-generation light combat aircraft—features an advanced AESA radar, improved avionics, and a 50% indigenous content level. Deliveries are slated to begin in 2025, with HAL aiming to ramp up production to 24 jets annually by 2028, potentially completing the order within seven years. Even with this infusion, the IAF will still need 270 more jets to meet its 2040 target.

Looking further ahead, the IAF is pinning hopes on the Tejas MkII, a more advanced variant with a heavier airframe, greater payload (6.5 tons), and the GE F414 engine. Expected to enter production by 2030 following its first flight in 2027, the MkII aims to fill the medium-weight fighter gap left by retiring Mirage 2000s and Jaguars. The IAF projects a fleet of 120 Tejas MkII jets by 2040, reducing the shortfall to 150 aircraft. However, this timeline hinges on HAL overcoming past delays and scaling up manufacturing capacity—a challenge given the Tejas Mk1A’s protracted development.

The Advanced Medium Combat Aircraft (AMCA), India’s ambitious 5th-generation stealth fighter, is another pillar of this strategy. Developed by the Aeronautical Development Agency (ADA), the AMCA MkI is slated for service entry by 2035, featuring stealth, supercruise, and internal weapons bays. By 2040, the IAF anticipates inducting at least 40 AMCA MkI jets, with around 20 MkII variants—equipped with an indigenous engine—joining later. This would bring the total to 60 AMCA jets, cutting the remaining gap to 90 aircraft. Yet, the AMCA’s timeline is optimistic, with funding, engine development (a joint venture with Safran or Rolls-Royce), and stealth technology integration posing risks to its 2035 debut.

This persistent shortfall of 90-110 jets explains the IAF’s urgency to expedite the Multi-Role Fighter Aircraft (MRFA) program, a $25 billion tender for 114 foreign-built jets with significant local production. Contenders include the Rafale (France), F/A-18 Super Hornet (U.S.), Typhoon (Eurofighter), and Su-35 (Russia), with the Rafale leading due to the IAF’s existing 36-jet fleet. The MRFA aims to deliver 110 jets by 2040, effectively closing the gap while providing a proven 4.5-generation platform to complement the indigenous fleet. However, the program has languished since its inception in 2018, bogged down by bureaucratic delays, cost negotiations, and debates over “Make in India” compliance.

The IAF’s 15-year roadmap thus envisions a mix of 180 Tejas Mk1A, 120 Tejas MkII, 60 AMCA, and 110 MRFA jets—totaling 470 aircraft—exceeding the 450-jet requirement and potentially restoring the 42-squadron strength. This ambitious plan, however, faces significant challenges. HAL’s production rate, historically capped at 8-16 jets annually, must double to meet Mk1A deadlines, while the MkII and AMCA rely on untested timelines. The MRFA’s fate hangs on political and financial approvals, with X posts from defense analysts suggesting 2025 could be a make-or-break year for the tender.

Strategically, this buildup is driven by China’s expanding J-20 stealth fleet and Pakistan’s JF-17 Block III upgrades, both of which threaten India’s air dominance. The IAF’s current fleet—comprising Su-30 MKIs, Rafales, and Tejas Mk1s—offers resilience, but numbers matter in a two-front war scenario. By 2040, a balanced force of 4.5- and 5th-generation jets could deter aggression, but only if procurement aligns with retirement schedules.

NOTE: AFI is a proud outsourced content creator partner of IDRW.ORG. All content created by AFI is the sole property of AFI and is protected by copyright. AFI takes copyright infringement seriously and will pursue all legal options available to protect its content.