SOURCE: AFI

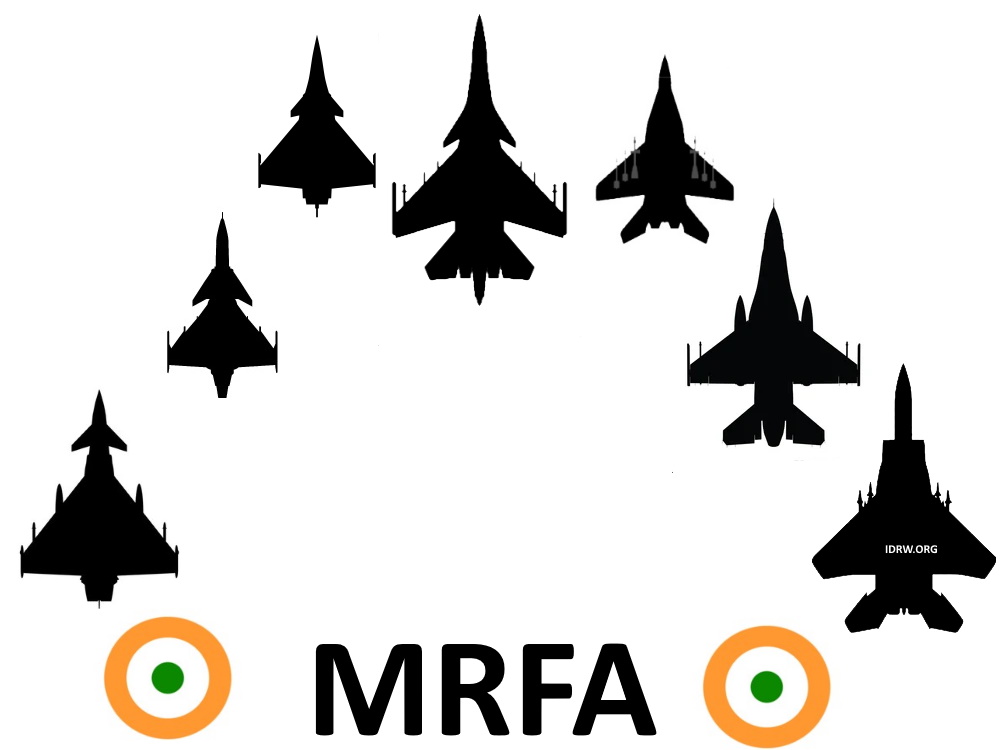

India’s Multi-Role Fighter Aircraft (MRFA) tender has attracted global aerospace leaders, each offering their state-of-the-art aircraft to meet the Indian Air Force’s needs for a high-performance, versatile fleet. An essential factor in selecting the best fit for the MRFA program is production rate, as India aims to maintain a steady and reliable acquisition timeline.

Production rate not only affects the timely delivery of aircraft but also highlights the manufacturing capacity and export viability of each contender. This article compares the production capabilities of top MRFA candidates to determine which aircraft has the best track record in terms of production rate.

Key Contenders in the MRFA Tender

The primary contenders in India’s MRFA tender include:

F/A-18 Super Hornet by Boeing (U.S.)

F-15EX and F-21 by Boeing and Lockheed Martin (U.S.)

Rafale by Dassault Aviation (France)

Eurofighter Typhoon by Eurofighter GmbH (a consortium of Airbus, BAE Systems, and Leonardo)

Gripen E/F by Saab (Sweden)

Su-35 by Sukhoi, part of the United Aircraft Corporation (Russia)

Each of these aircraft has distinct advantages and serves as the backbone of various air forces worldwide. However, their production capacities vary significantly based on supply chain robustness, facility capacities, and historical delivery rates.

F-15EX (Boeing, USA)

The F-15EX, developed by Boeing, represents the latest evolution of the F-15, with production and modernization systems already in place due to continued production for the U.S. Air Force. Boeing’s facility in St. Louis is capable of producing around 24 to 36 aircraft annually, depending on orders and operational needs. The F-15EX’s production lines have recently been upgraded, allowing for rapid ramp-up if required. This adaptability makes the F-15EX one of the contenders with a strong production rate, especially since it shares components and manufacturing techniques with other Boeing projects.

F-21 (Lockheed Martin, USA)

The F-21, a variant of the F-16 designed specifically for India, benefits from Lockheed Martin’s experience in high-rate production of F-16s. Lockheed Martin’s F-16 line has demonstrated high production rates, delivering up to 30–40 aircraft annually when demand peaks. For the F-21, Lockheed Martin has proposed establishing a production line in India in collaboration with Tata Advanced Systems, a move that could further enhance the production rate tailored to Indian needs. The F-16’s established supply chain and mature production framework allow the F-21 to maintain a high production rate, giving it an edge in timely fulfillment.

Dassault Rafale (France)

Dassault Aviation’s Rafale is in production for the French Air Force and international clients, including the Indian Air Force, which already operates 36 Rafale jets. Dassault’s production rate is around 11 to 15 aircraft per year, with scope to increase if additional orders are secured. For the Rafale, Dassault has consistently met delivery schedules for various international orders but operates on a comparatively smaller scale than Boeing or Lockheed Martin. If selected, Dassault would need to further expand production facilities or establish an Indian assembly line to meet India’s desired acquisition timeline.

Eurofighter Typhoon (Eurofighter GmbH)

The Eurofighter Typhoon, produced by a consortium of European defense giants (Airbus, BAE Systems, and Leonardo), has a variable production rate based on fluctuating demand among member nations. At its peak, the Eurofighter production line delivered approximately 20–25 aircraft annually. However, current production rates are lower due to fewer orders. The consortium’s decentralized production model allows for flexibility, which could be advantageous for scaling up if additional MRFA orders materialize. However, establishing a new production line or assembly plant in India would require significant time and investment.

Saab Gripen E/F (Sweden)

The Gripen E/F, produced by Saab, has an efficient production system designed for rapid scale-up. Currently, Saab maintains a production rate of approximately 16 to 20 aircraft annually, primarily fulfilling orders from Sweden and Brazil. Saab has proposed transferring technology to India and setting up a local production line in partnership with Indian industry, which could significantly bolster production capacity. Saab’s flexible production model and smaller aircraft design make it easier to achieve a high output, potentially positioning the Gripen E/F as one of the more scalable options in the MRFA competition.

Su-35 (Russia)

The Su-35, manufactured by Russia’s United Aircraft Corporation (UAC), has historically operated at a moderate production rate due to limited orders and a focus on Su-57 development. The UAC has a capacity of around 10 to 15 aircraft per year, although this can vary based on operational requirements and export orders. While the Su-35 has a reliable production system, UAC would need to significantly ramp up its capabilities or establish an Indian assembly line to meet the MRFA’s requirements. Additionally, production rates may be affected by global geopolitical considerations and supply chain constraints.

F/A-18 Super Hornet (Boeing, USA)

The F/A-18 Super Hornet, also produced by Boeing, has a production capacity similar to that of the F-15EX, with the ability to produce up to 24 aircraft annually. With a well-established production line in the U.S. and potential plans to shift manufacturing to India, Boeing’s Super Hornet can deliver a high production rate if needed. Boeing has a strong logistical support system, which adds to the feasibility of achieving a consistent production rate, making it a strong contender in terms of timely deliveries.

Conclusion: Which Aircraft Has the Best Production Rate?

Based on current production capacities, the F-16/F-21 by Lockheed Martin and the F-15EX by Boeing stand out as the aircraft with the highest production rates among the MRFA contenders, capable of producing 30–40 and 24–36 aircraft annually, respectively. The Saab Gripen E/F and F/A-18 Super Hornet also offer robust production capacities that could meet India’s timelines with some flexibility.

For Dassault’s Rafale and the Eurofighter Typhoon, production rates may need to be expanded or supported by additional facilities in India to meet India’s demands. The Su-35, while highly capable, would likely face challenges in ramping up production without significant investment in infrastructure and logistics.