SOURCE: AFI

Boeing, a titan of aerospace engineering, faced a precarious moment in recent years when its fighter jet division teetered on the brink of closure. A dwindling order book for its iconic F/A-18 Super Hornet and F-15 Eagle variants painted a grim picture for the company’s military aviation arm. Yet, in a stunning turnaround, Boeing has emerged victorious in the U.S. Air Force’s (USAF) Next Generation Air Dominance (NGAD) program, securing the contract to develop the F-47—a sixth-generation fighter jet that promises to redefine air superiority. This remarkable comeback underscores Boeing’s resilience, strategic investments, and ability to pivot at a critical juncture.

Boeing’s fighter jet lineage, inherited largely through its 1997 merger with McDonnell Douglas, includes storied aircraft like the F-15 Eagle and F/A-18 Super Hornet. These platforms have been mainstays of U.S. and allied air forces for decades. However, by the early 2020s, the company faced a stark reality: orders for new F-15s and F-18s were drying up. The F/A-18 Super Hornet production line, based in St. Louis, Missouri, was slated to wind down by 2027 after fulfilling final orders from the U.S. Navy and export customers like Australia. Meanwhile, the F-15EX Eagle II, a modernized variant, secured a modest USAF contract for 144 units, but this alone couldn’t sustain the division’s long-term viability.

The rise of Lockheed Martin’s F-35 Lightning II, a fifth-generation stealth fighter, shifted the market’s focus, siphoning demand away from Boeing’s 4.5-generation offerings. 2023 noted Boeing’s announcement that it would shutter the Super Hornet line, redirecting efforts toward advanced projects—a signal that the company saw no future in its legacy fighters without a major new program. With no clean-sheet fighter design victories in its history (its successes being McDonnell Douglas legacies), Boeing’s fighter division faced an existential crisis. Analysts speculated that without a significant contract, the St. Louis facility—once a hub of fighter production—might pivot entirely to trainers like the T-7A Red Hawk or unmanned systems like the MQ-25 Stingray.

Amid this uncertainty, Boeing doubled down on its future. The company poured billions into modernizing its St. Louis facilities, betting heavily on the USAF’s NGAD program—a sixth-generation initiative to replace the aging F-22 Raptor. NGAD, envisioned as a “family of systems” with a crewed fighter (the Penetrating Counter-Air platform) at its core, demanded cutting-edge stealth, range, and adaptability. Boeing’s leadership saw this as their shot at redemption, a chance to leapfrog from legacy platforms to the forefront of aviation technology.

The gamble wasn’t without risk. Boeing’s defense arm had been battered by setbacks—cost overruns on the KC-46 Pegasus tanker, delays with the T-7A, and quality issues with its commercial 737 Max line had dented its reputation and finances. By 2023, the division reported over $18 billion in losses on fixed-price contracts since 2014. Yet, Boeing pressed forward, leveraging its experience with digital engineering (pioneered on the T-7A) and stealth technology from the F/A-18’s Block III upgrades. Posts on X from early 2025 highlighted Boeing’s “significant investment” in NGAD, with new factories rising in St. Louis—a clear sign of confidence despite the odds.

The NGAD competition pitted Boeing against Lockheed Martin, the incumbent giant behind the F-22 and F-35. Northrop Grumman, a third contender, bowed out in 2023, focusing instead on its B-21 Raider bomber. Lockheed, with its fifth-generation expertise, seemed the favorite, but Boeing’s persistence paid off. The USAF had been testing NGAD X-plane prototypes since 2020, and both companies refined their designs through Technology Maturation and Risk Reduction contracts extended into 2024. When the Biden administration paused NGAD in May 2024 over soaring costs—estimated at $300 million per jet—Boeing and Lockheed held their breath.

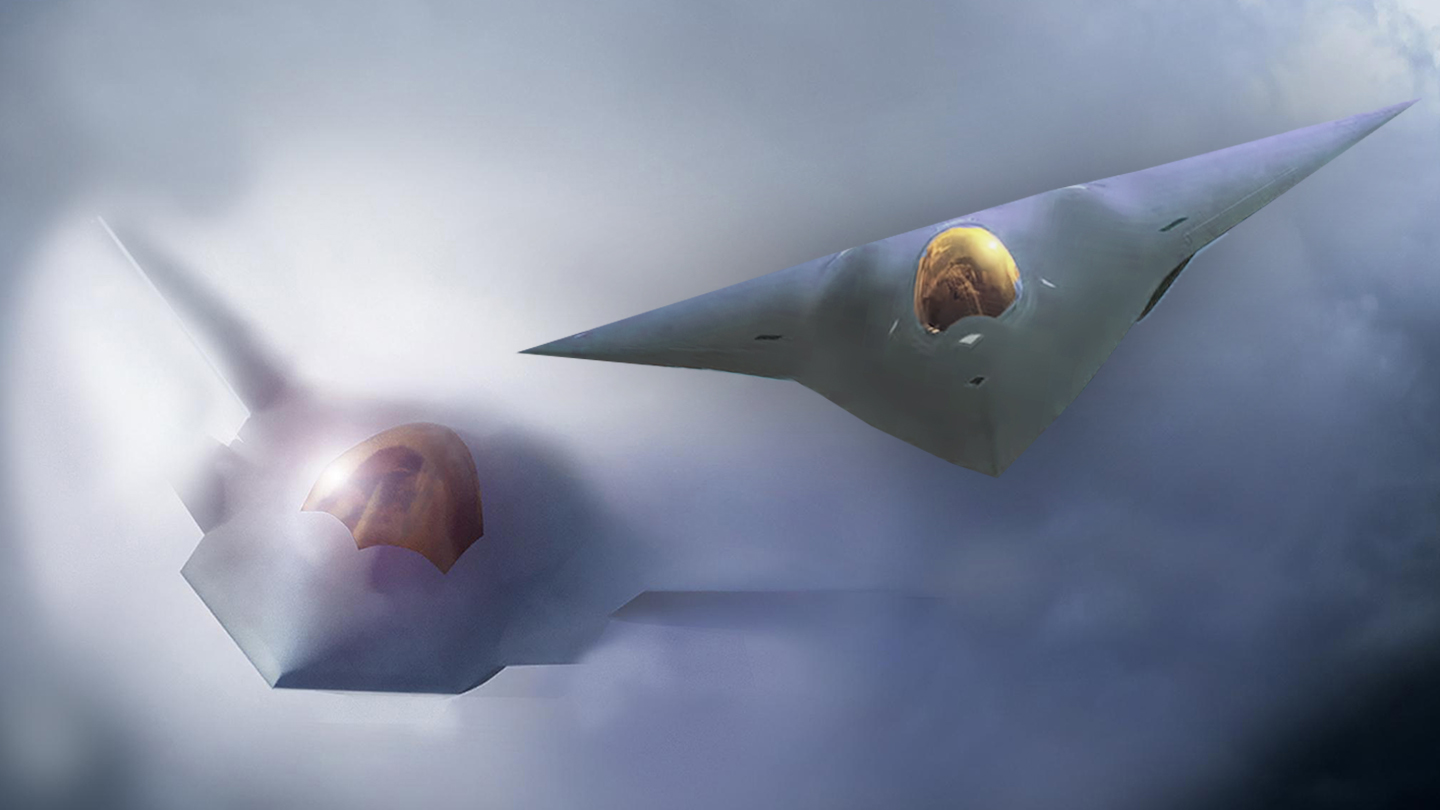

The Trump administration’s arrival shifted the tide. On March 21, 2025, President Donald Trump announced Boeing as the winner of the NGAD’s Engineering and Manufacturing Development (EMD) phase, designating the aircraft the F-47. The decision, made after a USAF study confirmed NGAD’s necessity against China’s advancing sixth-generation jets, was a lifeline for Boeing. The F-47, slated to fly by 2029, promises longer range, advanced stealth, and integration with Collaborative Combat Aircraft (CCA) drones—features tailored to dominate contested Indo-Pacific skies.

The F-47 contract, valued at over $20 billion for EMD alone, with potential orders in the hundreds of billions, revitalizes Boeing’s fighter division. The St. Louis line, nearly dormant, will now hum with sixth-generation production, preserving jobs and expertise. The win also breaks Lockheed’s monopoly on USAF fighters, ensuring competition in an industrial base critics feared was atrophying. Boeing’s stock surged 7% post-announcement, while Lockheed’s dipped 5.7%, reflecting market confidence in this turnaround.

The F-47’s name nods to the P-47 Thunderbolt’s WWII legacy, the Air Force’s 1947 founding, and Trump’s tenure as the 47th president—a symbolic trifecta. Though design details remain classified, USAF Chief of Staff Gen. David Allvin touts its sustainability and lower manpower needs compared to the F-22, hinting at a revolutionary leap. For Boeing, it’s a clean-sheet victory—its first ever—proving the company could innovate beyond its McDonnell Douglas inheritance.

NOTE: AFI is a proud outsourced content creator partner of IDRW.ORG. All content created by AFI is the sole property of AFI and is protected by copyright. AFI takes copyright infringement seriously and will pursue all legal options available to protect its content.