SOURCE: AFI

On March 25, 2025, GE Aerospace marked a significant milestone by delivering the first of 99 F404-IN20 engines to Hindustan Aeronautics Limited (HAL) for India’s Tejas Light Combat Aircraft (LCA) Mk1A program. The delivery, celebrated as a step forward in the 40-year partnership between GE and HAL, came after a two-year delay that had sparked concerns within the Indian Air Force (IAF) and drawn scrutiny from New Delhi. While the arrival of the engine signals progress, GE’s accompanying statement subtly pointed to a deeper issue: a five-year gap in orders that left its production line dormant, contributing to the prolonged wait.

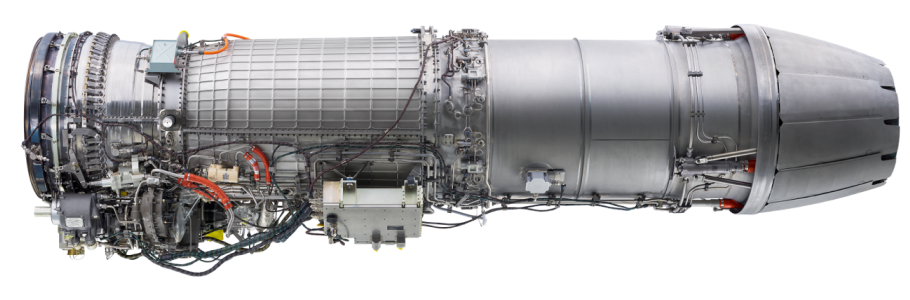

The F404-IN20, a customized variant of GE’s proven F404 engine family, powers the LCA Mk1A, an advanced iteration of India’s indigenous fighter jet designed to bolster the IAF’s combat capabilities. By 2016, GE had delivered 65 of these engines to HAL for the earlier Tejas Mk1 jets. With no further orders on the horizon, the company shuttered the F404-IN20 production line, citing a lack of visibility on future business. It wasn’t until 2021, when HAL placed an order for 99 engines following the Cabinet Committee on Security’s approval of an 83-aircraft LCA Mk1A contract, that GE faced the daunting task of restarting a dormant supply chain.

In a carefully worded statement, GE acknowledged the challenge: “Restarting a jet engine production line is a complex process, made even more difficult during the COVID pandemic.” The five-year hiatus between the last delivery in 2016 and the 2021 order left the company scrambling to re-engage suppliers and ramp up production. While GE emphasized its commitment to quality and safety, the subtext was clear: the absence of consistent orders from India had left the production ecosystem idle, amplifying the delays when demand suddenly surged.

The delay, which pushed the first engine delivery from an anticipated 2023 timeline to March 2025, had significant ripple effects. HAL, tasked with delivering 83 LCA Mk1A jets to the IAF under a ?48,000-crore deal signed in February 2021, faced production setbacks as it awaited the engines. The IAF, already grappling with a squadron strength of 31 against a sanctioned 42.5, grew increasingly vocal about the risks to its modernization plans. India responded by invoking a penalty clause against GE in late 2024, though the government has remained tight-lipped about the financial details, framing it as a standard contractual measure rather than a punitive escalation.

GE’s narrative subtly shifts some responsibility back to India’s procurement process. The five-year gap, as highlighted by the company, raises questions about the pace of decision-making between the last F404-IN20 delivery and the LCA Mk1A contract. While HAL and the IAF finalized requirements and funding, the lack of interim orders allowed the production line to lapse—a decision that, in hindsight, proved costly. The situation was compounded by global supply chain disruptions during the pandemic, but GE’s point is unmistakable: sustained demand could have kept the line active, mitigating the restart challenges.

Despite the delays, GE has now committed to delivering 12 engines by December 2025, with plans to scale production to 20 units annually by 2026. HAL, meanwhile, has kept its assembly lines humming, using reserve Category-B engines for initial Mk1A test flights—like the maiden flight of LA 5033 in March 2024—while awaiting the new powerplants. The company’s new Nashik facility, combined with its Bengaluru line, boosts its capacity to 24 aircraft per year, signaling readiness to meet IAF deadlines once the engine supply stabilize

NOTE: AFI is a proud outsourced content creator partner of IDRW.ORG. All content created by AFI is the sole property of AFI and is protected by copyright. AFI takes copyright infringement seriously and will pursue all legal options available to protect its content.